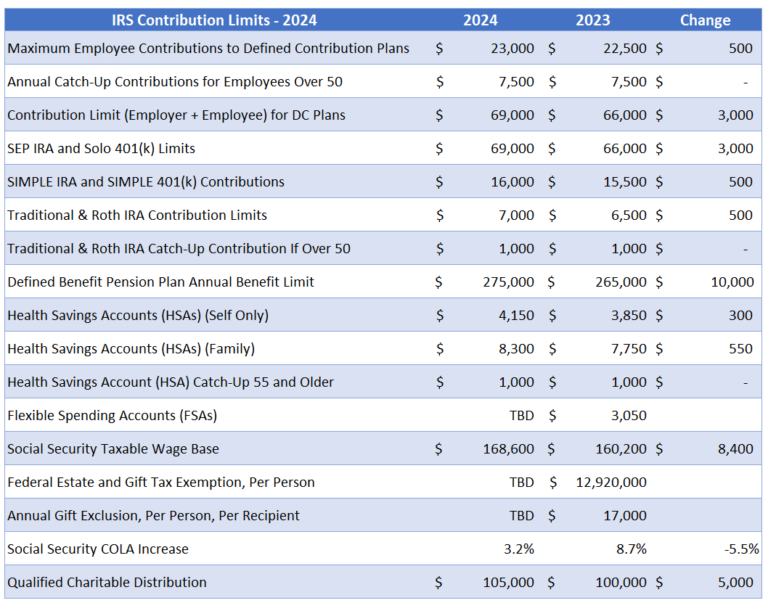

Irs Deferred Compensation Limits 2024. 457 deferred compensation plan contribution limits* 2024; The internal revenue service recently announced 2024 dollar limits for qualified retirement plans (including 401(k) plans), deferred compensation plans, and.

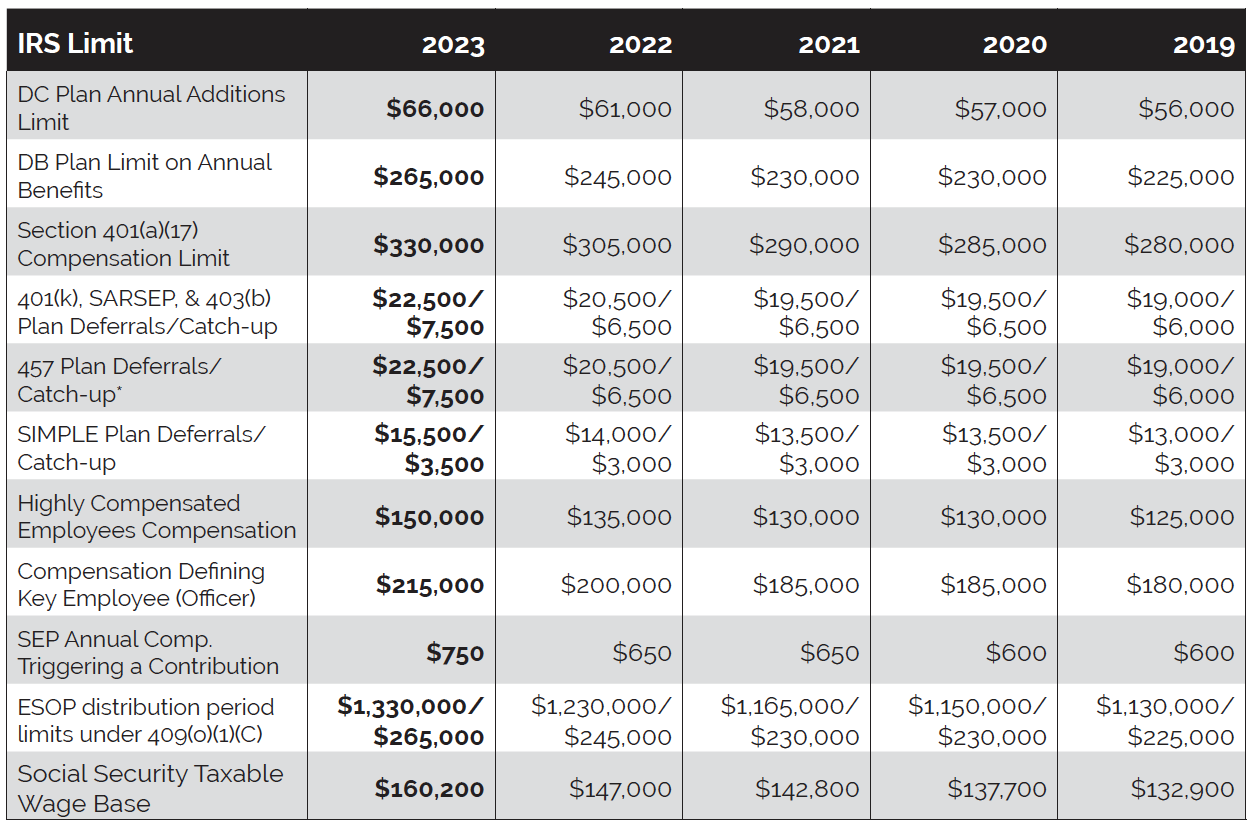

$19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;. The updated limits for 2024, as compared to last year’s limits, are set forth in the charts below.

The Updated Limits For 2024, As Compared To Last Year’s Limits, Are Set Forth In The Charts Below.

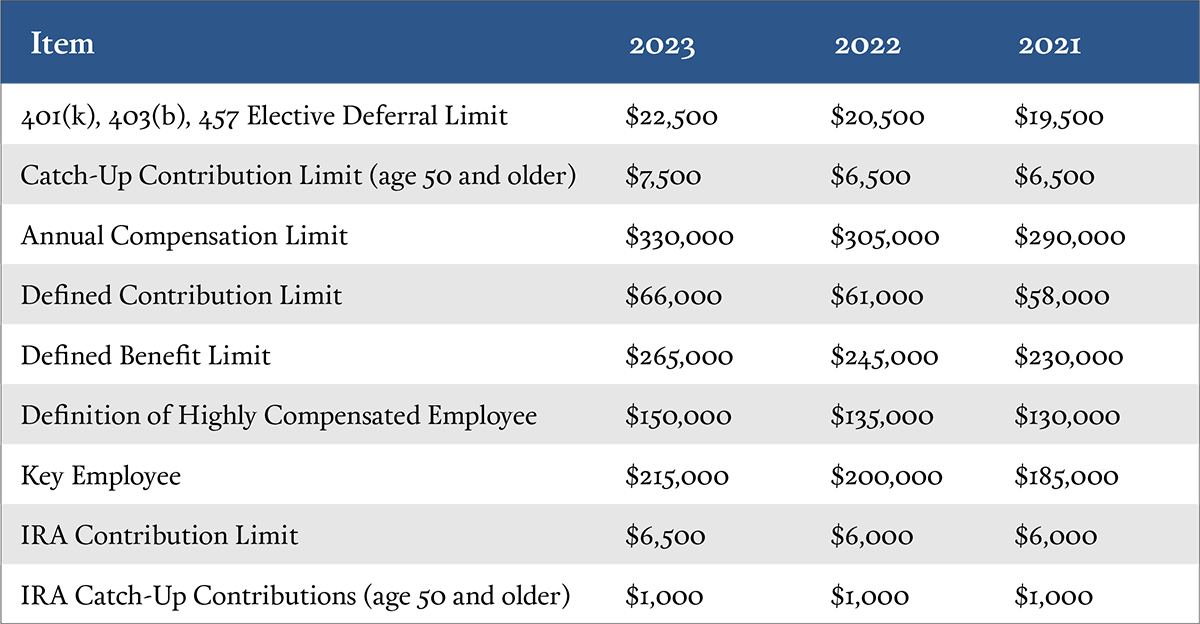

Several key figures are highlighted below.

Qualified Retirement Plan Contribution Limits.

The irs just released the 2024 contribution limits on qualified 401(k) plans.

The Irs Has Just Announced The New Contribution And Benefit Limits For 2024 And—Reflecting The Moderating Inflation Readings, The Increases Are Modest.

Images References :

Source: www.midlandsb.com

Source: www.midlandsb.com

Plan Sponsor Update 2023 Retirement Plan Limits Midland States Bank, $19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;. $19,500 in 2020 and in 2021 for.

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2023 Aegis Retirement Aegis Retirement, The limit on deferrals under section 457(e)(15), which pertains to deferred compensation plans of state and local. The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024.

Source: www.homesteadfunds.com

Source: www.homesteadfunds.com

Deferred Compensation Restoring Limited 401(k) Contributions, The irs has just announced the new contribution and benefit limits for 2024 and—reflecting the moderating inflation readings, the increases are modest. The updated limits for 2024, as compared to last year’s limits, are set forth in the charts below.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, The irs just released the 2024 contribution limits on qualified 401(k) plans. Deferred compensation is a payment model in which a portion of an employee’s salary pays out later.

Source: tabitomo.info

Source: tabitomo.info

Retirement Account Contribution Limits 2023 Tabitomo, Participant pretax contribution limit for irc section 401 (k) and. 100% of the participant's average compensation for his or.

Source: amandyqmartha.pages.dev

Source: amandyqmartha.pages.dev

Irs 401 K Contribution Limits 2024 Angele Colline, Past year limits are also posted on the irs website in a historical table. 457 deferred compensation plan contribution limits* 2024;

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Here's When You'll A 401(k) Millionaire Financial Samurai, 100% of the participant's average compensation for his or. Participant pretax contribution limit for irc section 401 (k) and.

Source: www.pinnaclequote.com

Source: www.pinnaclequote.com

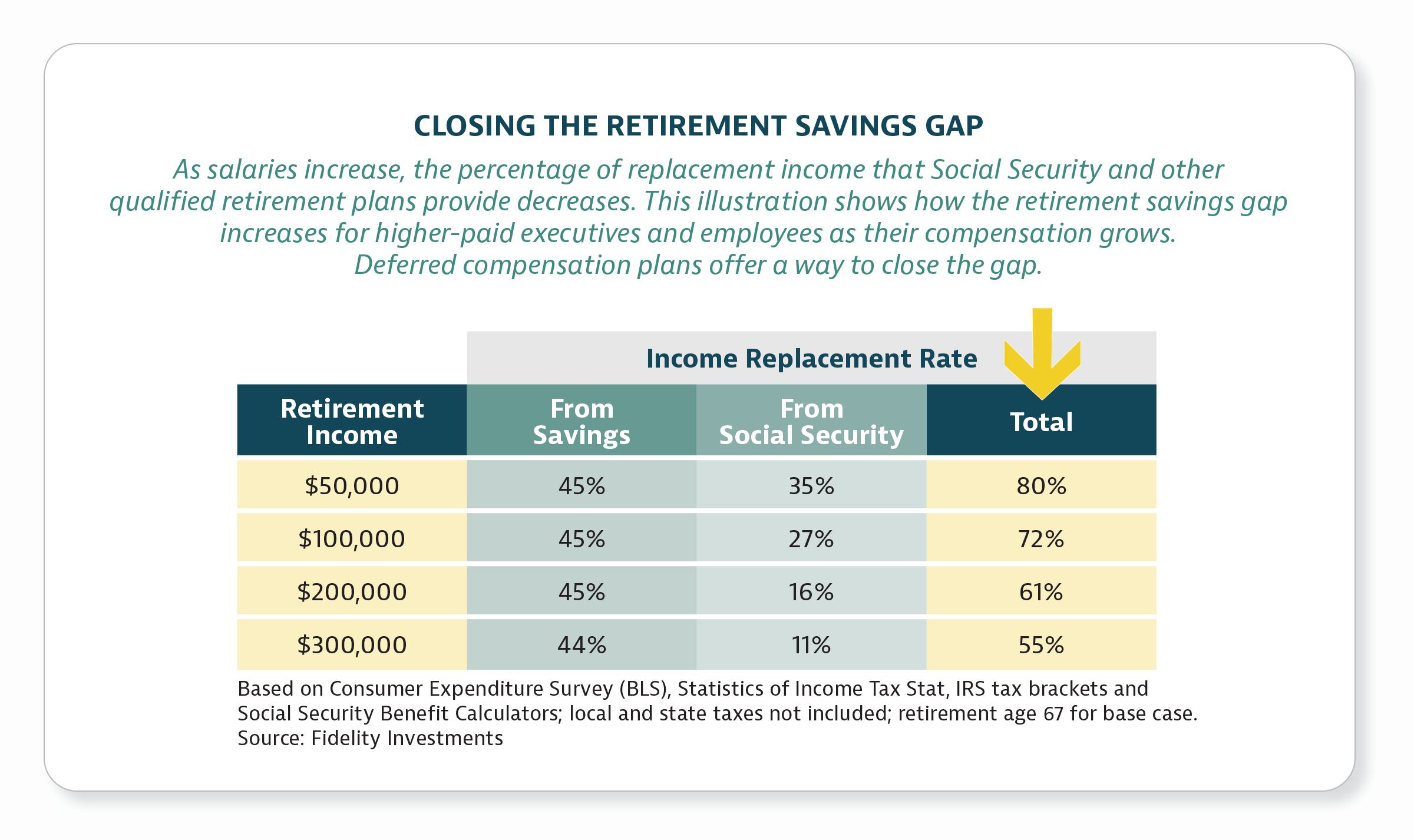

Business Life Insurance, The Truth About Deferred Compensation Plans, The normal contribution limit for elective deferrals to a 457 deferred compensation plan is increased to $23,000 in 2024. Increase in contribution limits for 457(b) plans:

Source: safelandingfinancial.com

Source: safelandingfinancial.com

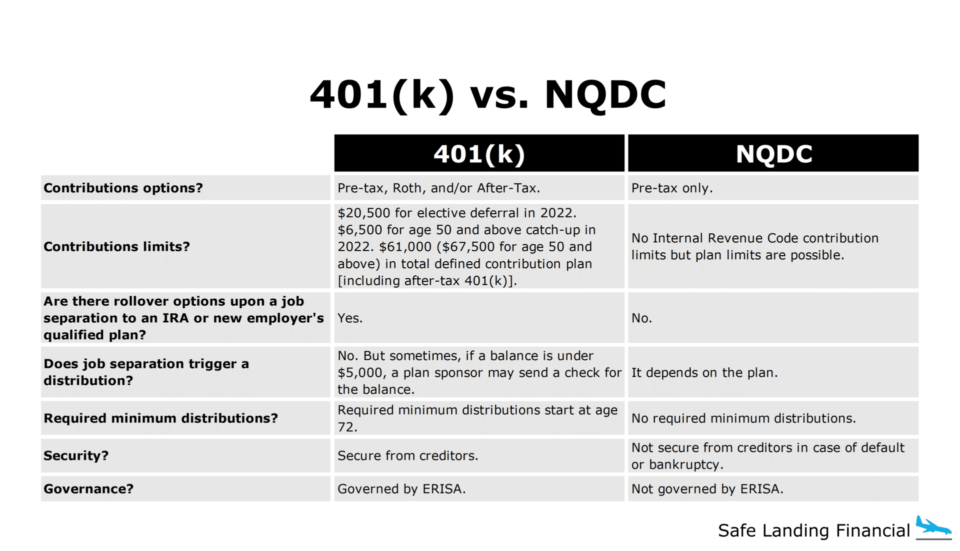

Deferred Compensation Guide + Case Study, The updated limits for 2024, as compared to last year’s limits, are set forth in the charts below. Annual deferral limit for participants younger than age 50:

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The 401(a) compensation limit (the amount of earned income that can be used to calculate retirement account contributions) will increase from $330,000 in 2023. 100% of the participant's average compensation for his or.

Annual Deferral Limit For Participants Younger Than Age 50:

Deferred compensation is a payment model in which a portion of an employee’s salary pays out later.

Increase In Contribution Limits For 457(B) Plans:

Participant pretax contribution limit for irc section 401 (k) and.